Fincen Filing Requirements 2024 Filing Requirements

Fincen Filing Requirements 2024 Filing Requirements. In line with international counterparts by. The final rule is an attempt by fincen to strengthen and protect the u.s.

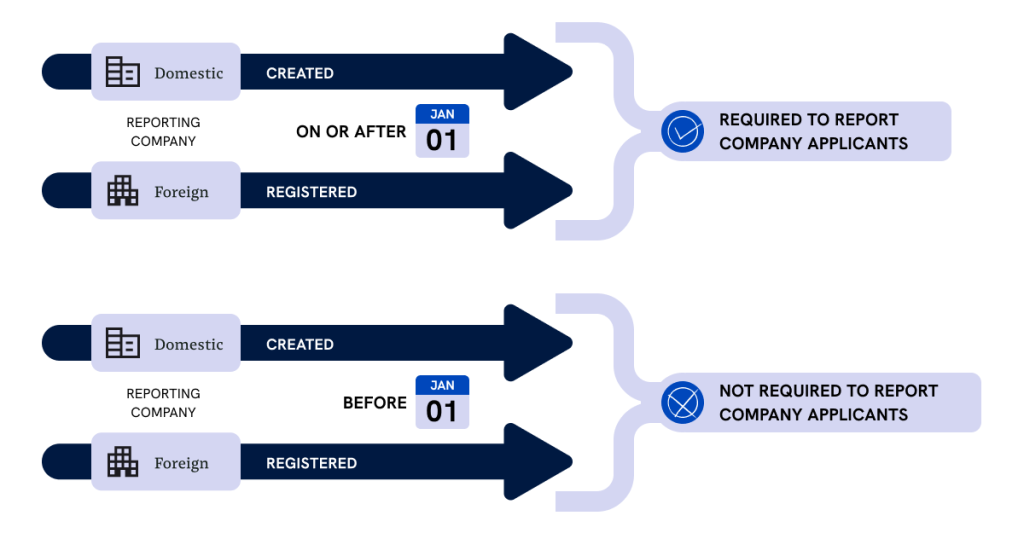

Information on how to submit beneficial ownership information to. Effective january 1, 2024, reporting companies will be required to provide information regarding the company and its beneficial owners to the financial crimes.

Fincen Filing Requirements 2024 Filing Requirements Images References :

Source: andereawrosy.pages.dev

Source: andereawrosy.pages.dev

Corporate Transparency Act 2024 Fincen Betsey Orelle, Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

Source: millerverchota.com

Source: millerverchota.com

Understanding Beneficial Ownership Information Reporting Requirements, The cta authorizes fincen to maintain a centralized, nonpublic database of beneficial ownership information (boi), accessible to law enforcement agencies,.

Source: www.youtube.com

Source: www.youtube.com

New LLC Law Filing Requirements Simplified FinCEN Beneficial Owner, 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network (fincen) to identify those.

Source: seattlebusinessapothecary.com

Source: seattlebusinessapothecary.com

Filing your BOI Report with FINCEN a New Requirement for LLCs/PLLCs, Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

Source: rodriguezmccloskey.com

Source: rodriguezmccloskey.com

Understanding The New FinCEN Reporting Requirements Rodriguez, For llcs formed on or after january 1, 2025:

Source: www.tax1099.com

Source: www.tax1099.com

FinCEN BOI Reporting Requirements in 2024 Tax1099 Blog, On october 3, 2024, the financial crimes enforcement network (fincen) issued new guidance concerning the corporate transparency act (cta) by updating.

Source: www.tax1099.com

Source: www.tax1099.com

FinCEN BOI Reporting Requirements in 2024 Tax1099 Blog, 1, 2024, with reporting companies created or registered before that date required to file their initial reports by jan.

Source: viktorlaw.com

Source: viktorlaw.com

All You Need To Know About Beneficial Ownership Information Reporting, Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

Source: www.kitces.com

Source: www.kitces.com

FinCEN's 2024 New Beneficial Ownership Information (BOI) Reporting, On november 29, 2023, fincen extended the deadline for companies created or registered in 2024 to provide 90 days—instead of the original 30 days—from formation to file their initial report.

Source: www.forestdatanetwork.com

Source: www.forestdatanetwork.com

Navigating the New FinCEN Requirements for U.S.…, The cta authorizes fincen to maintain a centralized, nonpublic database of beneficial ownership information (boi), accessible to law enforcement agencies,.

Category: 2024